From grail watches to grail art: how Matis is redefining collecting

Matis opens access to blue-chip art investing—from €20,000—featuring icons like Basquiat, Warhol, and Picasso. A new era for collectors and investors alike.

And what if your next "grail" wasn't a watch?

Picasso, Warhol, Basquiat... Just like in watchmaking, certain artworks are considered the Holy Grail for collectors. With Matis, these exceptional pieces become accessible, in the form of co-investment, starting from €20,000. A new way to collect—and invest.

The works of Basquiat, Picasso, or Warhol are no longer a dream reserved for a happy few. Since May 2023, the French company Matis – the first of its kind regulated by the AMF (Autorité des marchés financiers) – allows entry into the exclusive world of "blue chip" art from €20,000.

Relying on strict selection criteria (market stability, museum renown, liquidity, valuation), and collaborating with the most influential galleries, Matis structures co-investments in high-potential artworks. The company targets an average net performance in the double digits over an average period of 2 years for a diversified portfolio. With an average net performance of 14.45% for the first resold artworks*- over eight months, this model appeals to both art enthusiasts and investors seeking diversification. An interview with François Carbone, co-founder.

(Warning: Past performance does not guarantee future performance. Investing in unlisted assets carries a risk of partial or total loss of the invested capital.)

WorldTempus: Matis acquires and resells artworks deemed "blue chip," considered more interesting from an investment perspective. Can you tell us more?

François Carbone: "Blue chip" defines, in the stock market, "safe" companies – whose risk is considered lower. In the art market, the term qualifies artworks worth more than six figures. These are pieces ranging from €500,000 to €5 million by highly recognized artists, valued by museum institutions and widely traded worldwide. We chose this segment of the art market because it meets our investment criteria: security, liquidity, performance (not guaranteed).

How do these artworks meet these criteria?

First, security: Picasso, Warhol, Basquiat, Léger, Baselitz have nothing left to prove. These artists are part of the art history heritage and are valued by institutions, namely museums. Their value is likely to endure. We sometimes contribute to this institutional valuation by lending some of our clients' artworks to museums for their exhibitions.

Next, liquidity: we plan to sell these artworks on average within two years after the investment, with a maximum investment duration of 5 years. This allows us to sell at the right time without excessively lengthening the cycle. These are highly collected artworks, whose artists are represented by major galleries – these same galleries assist us in reselling the artworks. Finally, performance (not guaranteed): this is the segment where the risk/return ratio is the most balanced.

We monitor about 120 artists, from early 20th century moderns to contemporary artists already recognized by institutions (usually over 70 years old). Their pieces are highly collected – just like a "grail watch," that cult watch every enthusiast dreams of adding to their collection.

How do you acquire these sought-after artworks at attractive prices?

Our business relies on our ability to source pieces below their market value. We know precisely the market prices i.e. what collectors are willing to pay, which allows us to identify good opportunities, during auctions or via our private network.

A concrete example: we work a lot with serial artworks. Some artists have repeated motifs – like Andy Warhol, with more than 70,000 works to his credit. Type "Andy Warhol flowers" in a search engine: you’ll see many, in different formats and colors. If we spot a flower in an equivalent format but in another tint, we can deduce a precise valuation from the other works in that same series already sold. We select only artworks offering a sufficient discount to generate a non-guaranteed surplus value at resale – while allowing the gallery to secure its own margin.

How do you ensure the sale afterward?

We systematically work with partner galleries. At Art Basel, for instance, several dealers present these artworks. The interest is mutual: the gallery shares the margin with the investors but can thus optimize the depth of its stock, and therefore its presence at fairs and feed its collector base.

Take a Pierre Soulages artwork displayed on a stand: it immediately attracts other amateurs of the same artist, who themselves may be willing to entrust pieces to the gallery. There is a real attraction effect. Logistically, only the insurance, hanging, and transport costs are incurred by the dealer.

Do some Matis members also invest out of passion?

Absolutely. All profiles coexist: rational investors, art enthusiasts, major collectors... Some take pleasure in co-investing with us, fully aware of the situation. It's always satisfying to see connoisseurs validate our choices.

You are a watch enthusiast. Which model did you start with?

For years, I had the IWC Portofino in mind – which I finally gifted myself at 26. It's a watch I still wear today. Since then, I’ve acquired others, which I initially thought I'd resell to buy new ones. But the emotional value of each piece is such that I ultimately can't part with them.

For you, does a watch mean investment or pleasure?

When you reach certain price levels, you inevitably wonder if the purchase can also be an asset. I like the idea that an object can combine aesthetics, emotion, and potential valuation. But I also buy other models purely for pleasure.

*Net investor performance: amount returned to the investor, net of all fees and before taxes, which corresponds to the difference between the sale price of the artwork and its acquisition amount, with the gallery commission fees, taxes, and Matis fees deducted.

A FEW KEY FIGURES

Art, a deep and dynamic market

Art has existed since the beginning of civilization and has been exchanged for centuries, representing a significant part of individuals' heritage. Since the 1960s, with the advent of the major auction houses and the increased accessibility of public auction results in the 1990s, it has been possible to measure precisely the volume, value and performance of transactions -making art a full-fledged asset class.

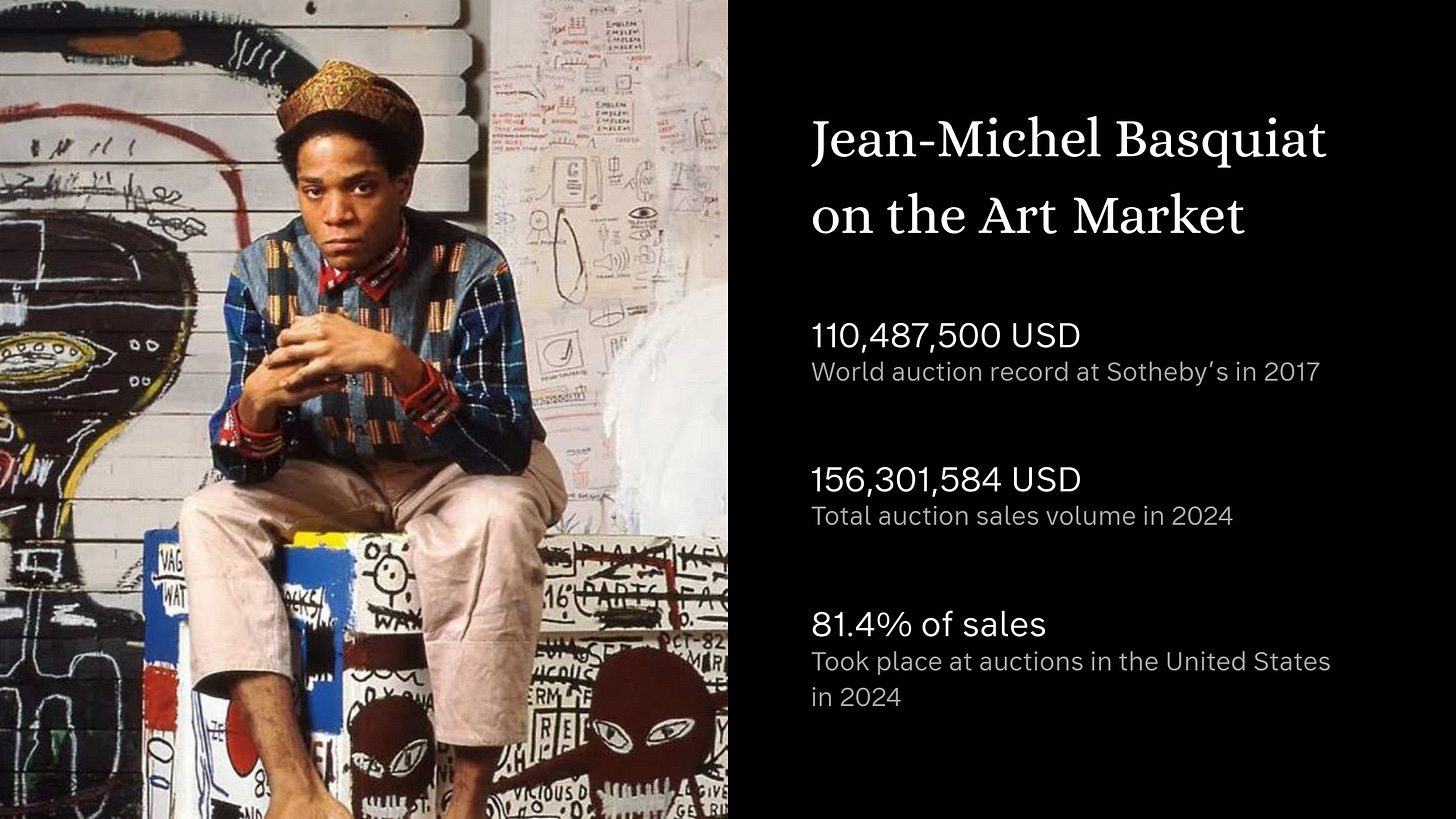

Matis Launches First Club Deal Featuring a Work by Jean-Michel Basquiat

Matis is introducing its first club deal centered on a piece by Jean-Michel Basquiat, the legendary American artist who rose to prominence in the 1980s. Celebrated for his bold, expressive style and global influence, Basquiat remains a key figure in contemporary art. His market has experienced strong growth, particularly in 2017 and 2021, highlighting a renewed interest from galleries and major auction houses.

FIND OUT MORE

Pop Art, an artistic revolution

Pop Art, according to the Larousse definition, is an artistic movement that exploits elements of mass popular culture, and originates from the social and economic transformations of the time. It draws inspiration from advertising, comic strips, popular music, and other elements of everyday life… Read more

Investing in art: the complete guide for 2024

Beyond its rewarding and stimulating nature, investing in art has many advantages in terms of potential financial profitability. But before you start, it is essential to know the fundamental bases of this particular type of investment. Discover the complete guide to investing in art in 2024 now… Read more